DeFi Passed $1B Total Value Locked: Grain of Salt

According to DeFi Pulse, last week, the total dollar worth of funds locked in Ethereum-powered DeFi projects passed the $1 billion mark. Currently, the Total Value Locked metric is $1.04 billion.

“$1 Billion marks an important milestone for DeFi to be celebrated,” DeFi Pulse website cheers.

The news of this milestone for DeFi resonated with an optimistic part of the crypto-community. While the $1B mark is rather a good sign for the nascent economic sector, there are things to consider before making conclusions.

What Happened?

On Friday, February 7th, DeFi Pulse estimated the total dollar value of the assets held in Ethereum smart contracts of DeFi projects to be over $1 billion.

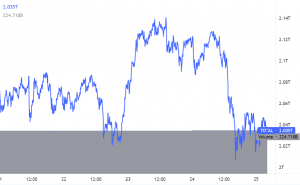

Total Value Locked in DeFi calculated in USD, 30-day chart. Source: DeFi Pulse

This number represents the assets like Ether or Dai people have locked in for different purposes: lending, swaps, hedging, etc. What is important, it doesn’t directly represent revenues or investment related to DeFi projects.

According to the researchers’ website, the metric called Total Value Locked (TVL) is calculated from the total balances of ETH and ERC-20 tokens held by the projects’ smart contracts. The total dollar worth is calculated by multiplying said balances by the dollar prices of the respective assets.

Since the beginning of 2020, the TVL metric was showing somewhat more active growth, then seen previously in 2019.

Total Value Locked in DeFi calculated in USD, 90-day chart. Source: DeFi Pulse

CoinDesk’s on-point article on the matter relayed the positive feedback they received MakerDAO’s creator Rune Christensen:

“It proves that people around the world want access to more efficient, less biased, money.”

They’ve also received a positive-tone note from Spencer Noon of DTC Capital:

“No other smart contract platform comes close in terms of its developer mindshare, tooling, and infrastructure, to the point where I don’t believe DeFi could exist anywhere else today. And perhaps most surprisingly, we’re finally seeing a credible case for ETH to accrue a long-term monetary premium as the only truly trustless collateral type in decentralized finance.”

The Twitter users are also glad to hear the news about $1 billion, as it seems from the #DeFi hashtag feed.

Total Value Locked in #DeFi : $1.01B 🚀

We’ve made history 😎🎉 pic.twitter.com/vrYl4kjqEx— Julien Bouteloup (@bneiluj) February 7, 2020

Yet, there is a set of additional circumstances to keep in mind when figuring out what it all means for the DeFi sector, Ethereum, and the crypto-industry.

What’s the Catch?

First and foremost, as it’s already been noted, the $1B total value locked number is heavily influenced by the Ether price involved in the calculations.

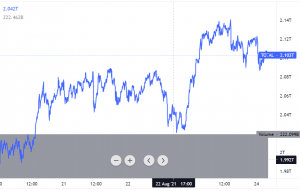

Ether locked in DeFi, 90-day chart. Source: DeFi Pulse

Currently, there are about 3.1 million ETH locked in that are involved in the TVL calculation. The price of Ether is $232.4. Therefore the ETH contribution to the dollar TVL is around $720.44 million or a bit over 72%.

Ether price in USD and BTC. Source: CoinMarketCap

Since TVL is this much dependent on Ether price, the recent rally of ETH price likely has to do with the milestone. Notably, the number of Ether locked decreased slightly since the peak of 3.198 million on January 30th.

This means that the $1 billion mark isn’t entirely emblematic of mass adoption coming on the back of DeFi projects. Moreover, there are certain scenarios, where such a lopsided disposition may not be desirable.

Mass Adoption or Bust

As the overwhelming majority of DeFi applications are powered by Ethereum, they share the technical risks with a network that may have issues with security and scalability. If Ethereum happens to be overloaded, processing times and transaction fees will get ugly. If it happens to be hacked, the DeFi sector will bear the consequences as well.

Another side of the issue is the price of Ether, which is predominantly used as collateral for loans with DeFi projects. In case of a sudden downturn in Ether price, a lot of users will find their loans uncollateralized and have to replenish the collateral balance. Some will not make it, therefore triggering margin calls. Smart contracts will try to automatically sell off the ETH in collateral, but if the drop is too steep, it won’t be able to redeem the loan in full. This means that people on both sides of the loan will lose money.

Considering the volatility of Ether and the recent rally, in particular, hypothetical worst-case scenarios from both economical and technical points of view are at least unnerving.

In an exclusive commentary for forklog.media, Max Pertsovsky, the Head of Growth at Waves Platform working with DeFi solutions, pointed out the important challenges the DeFi sector still has to overcome:

“Despite the major milestone reached, the adoption of DeFi currently lacks behind the promising theory. To fill the gap between theory and practice DeFi has yet to overcome its core issues: accessibility, capital inefficiency, unintuitive UX, hidden risks, regulation, and low liquidity. We are at an early development stage.”

He also noted that for the big breakthrough in DeFi to happen, we need more in terms of large-scale cryptocurrencies adoption, but the DeFi companies themselves should pay more attention to the current needs of their users:

“In order for DeFi to really matter, not just for the tech-savvy elite, but for the other 99.9%, we need to see broader cryptocurrency adoption and product go-to-market strategies that meet mass consumers where they are today and not where we want them to be.”

All in all, the $1 billion milestone is important as a representation of DeFi development, but also as a highlight of the sector’s dependence on the technological infrastructure and market moods. The business side of DeFi is another thing to improve.

“I believe DeFi will continue to create new hyper-efficient markets, but as long as these structural inefficiencies exist, DeFi will operate in parallel to traditional finance,” Max Pertsovsky added.

The DeFi sector and the crypto-industry have quite a way to walk. Milestones like the one in question add up and form the necessary credibility and trust to move on to bigger things. Even if the pretty round numbers are somewhat biased, the progress is obvious. Yet, it is important to keep the hype at bay and be considerate of the consequences that get bigger along with this new and hot sector.

Follow us on Twitter and Facebook and join our Telegram channel to know what’s up with crypto and why it’s important.

Source: forklog.media

View original post