Ether Staking Deposits Reach $85 Billion, Locking Up 25% of Circulating Supply

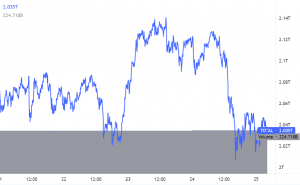

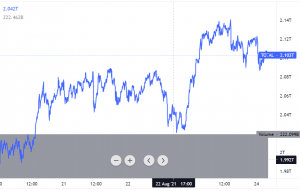

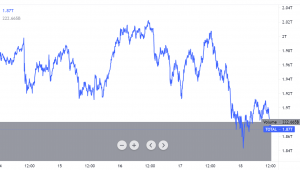

In the midst of surging staking demand, Ether’s price has seen remarkable progress, reaching an annual high of over $2,800. The total amount of Ether staked on the Beacon Chain has reached 30,206,801 ETH, valued at over $85 billion, effectively locking up nearly 25% of the total circulating supply. Currently, there are 943,974 active validators on the Beacon Chain, making February an ascending month for the Ethereum network. Between February 1 and 15, investors staked 600,000 Ether in Ethereum 2.0 staking contracts. February also witnessed an increase in the ETH price to an annual high of over $2,800. Ether is trading at $2,774 at the time of writing this report. A quarter of the circulating supply locked in Proof of Stake (PoS) contracts is considered a bullish sign for the Ethereum network. The increase in ETH staking enhances network security and efficiency while reducing the available ETH supply for trading on exchanges, leading to a supply decrease amid rising demand.

The Beacon Chain introduced PoS to the Ethereum ecosystem when it merged with the Ethereum mainnet Proof of Work (PoW) chain in September 2022, allowing validators to stake their ETH. Currently, ETH stakers receive an annual reward rate of 4%. The Ethereum PoS network is managed by a group of validators who must stake 32 ETH. The Beacon Chain started with 21,063 validators but now has over 900,000 validators. Following the Shanghai upgrade in April 2023, validators can now withdraw their staked ETH, and despite concerns of high withdrawal demand by validators, the amount of newly staked Ethereum surpassed withdrawals within a week after the upgrade. This indicates that validators are reinvesting their ETH for passive income.

Ethereum’s price has increased significantly in the past few weeks, entering double-digit growth and eyeing the $3,000 mark. With the approval of Bitcoin exchange-traded funds (ETFs) in the United States, attention has turned to Ether ETFs and whether the U.S. Securities and Exchange Commission will also approve them. Spot Ether ETFs could significantly impact the second-largest digital currency, as institutional demand for ETH adds to the decreasing market supply.