What is ERC-20?

1

What is ERC-20?

ERC stands for Ethereum Request for Comments. It’s the official protocol for proposing improvements to the Ethereum network. 20 stands for the number of the proposal. Technical specifications for tokens issued on Ethereum have been published in 2015. The tokens that meet those specifications are called ERC-20. In fact, they are smart contracts on the Ethereum blockchain. Even though they work within the framework of Ethereum, their functionality may vary as the limitations are not very strict.

ERC-20 determines the set of rules one has to observe so that the token could interact with other tokens on the network. The tokens themselves are blockchain assets that may or may not have value, and can be sent and received just like any other cryptocurrency.

2

Are ERC-20 tokens different from other cryptocurrencies?

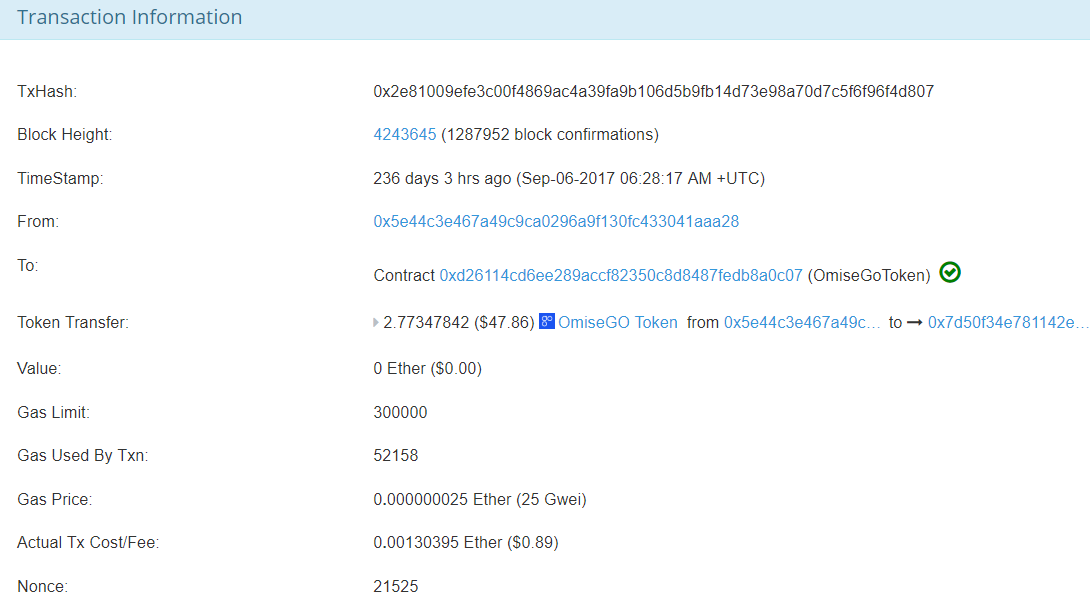

ERC-20 tokens can act only within the Ethereum network. They use the address format of the network and are sent via Ethereum transactions. This makes them different from other cryptocurrencies that have their own blockchain. The transactions are viewable in the special browser.

This transaction may look empty as the value field reads null. However, the number of tokens (here it’s OmiseGo) is in another field.

3

How are ERC-20 tokens useful?

ERC-20 tokens may work as shares, asset ownership certificates, loyalty points, or a cryptocurrency. Sometimes they may combine those functions. The most well-known ERC-20 tokens include Augur, Aeternity, BinanceCoin, EOS, Gnosis, and Wings.

4

What are the functions of the ERC-20 protocol?

ERC-20 has six mandatory and three optional parameters for each smart contract.

Mandatory functions include:

- totalSupply: responsible for the general issuance of tokens and ensures that no new tokens are minted once the limit has been reached.

- balance0f: determines the initial number of tokens assigned to a certain address.

- transfer: ensures the transfer of tokens to the user who bought them from the issuer.

- transferFrom: required for users to transfer tokens to each other.

- approve: required to check whether the smart contract can issue tokens.

- allowance: required to check whether the address has enough funds to send tokens elsewhere.

Optional parameters include the maximum number of digits after the decimal point (for comparison, bitcoin has eight); the token name, and its symbol. Those parameters enable exchanges and wallet providers to create a unified code base that can interact with any ERC-20 contract.

5

Is using ERC-20 risky?

As ERC-20 tokens are essentially smart contracts, they cannot be changed after the initiation, even though they may have bugs and vulnerabilities that can result in the loss of funds. The most infamous instance of that is the hack of The DAO back in 2016 and the loss of nearly $60 million. As a result, the Ethereum blockchain was hardforked and divided into Ethereum and Ethereum Classic in an attempt to rewind the consequences of the hack.

6

Are there any other problems with ERC-20?

ERC-20 can be too simplistic for certain objectives. As a result, there’s no guarantee that the token would be of any use or value. The same simplicity makes creating such tokens a very easy task in technical terms. Over 100 thousand ICO’s using ERC-20 tokens were launched in 2018 alone; some of those projects were very similar, while some others were scams.

Tokens can be mistakenly sent to the wrong address. If the smart contract does not provide for the option of fund retrieval, the funds will be lost forever. In 2017, there was $3 million worth of losses due to such mistakes. One may expect that the ERC-20 protocol will undergo some amendments in the future.

Source: forklog.media

View original post