CV Market Watch™: Weekly Crypto Trading Overview (November 29 – December 6, 2019)

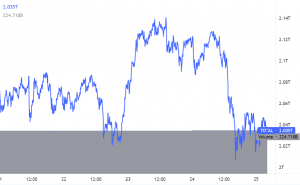

(BTC) moved between $7,000 and $7,500 for most of last week, with a rogue rally above $7,700. But the peaks did not have a cascade effect, and so far BTC remains stagnant.

Bitcoin (BTC) went through another volatile week, heading for the end of 2019 with prices about 50% below the yearly high. BTC traded at $7,409.82 on Friday, after sinking to a weekly low under $7,200. Trading volumes inched down to $17 billion in 24 hours, signalling a loss of activity.

The share of Tether (USDT) remained around 75%, as activity switched to futures markets. The BTC market cap dominance remained around 69.9%. BTC has narrowly avoided a critical bearish scenario, but there is not enough support for a bull rally.

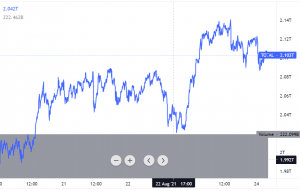

(ETH) rose to as high as $159, but sank again to $147.87. Interest in DeFi dropped, as the coin became more volatile. The Istanbul h…

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: investing.com

View original post