More Bitcoin Price Manipulation, or Upcoming Breakout? BTC Chart Analysis

The tight range continues to play out: Over the past two days, Bitcoin has kept the $10,000 support alive.

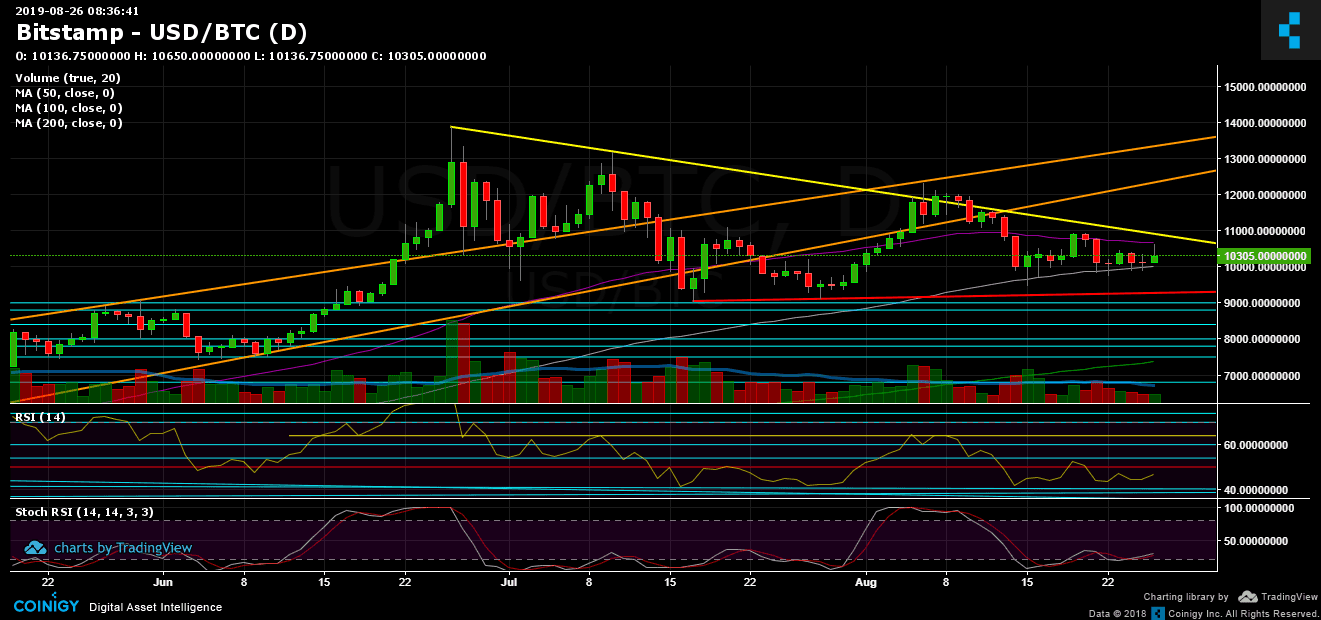

Moreover, Bitcoin didn’t break out of the aforementioned triangle formation. In recent hours, we saw Bitcoin’s price spike to a 5-day high: $10,805 on BitMEX (while on Bitstamp the highest price was $10,650). Since the price didn’t hold and quickly went down, it suggested continued Bitcoin price manipulation.

Keeping the above in mind, looking at the 4-hour chart, we can see that excluding the candle’s wick, the spike reached the upper boundary of the triangle.

Looking at the daily chart, the spike reached exactly the significant 50-day moving average line (marked in purple). So overall, the price is still within these boundaries: the 50- and 100-day moving average lines on the daily chart, and the triangle formation on the 4-hour chart.

It seems like a breakout is indeed coming up. But will the bulls gain sufficient momentum? Or will the bears push the price down to the lower boundary of the triangle for maybe the tenth time and try to break beneath the $10,000 support area?

Total Market Cap: $268 billion

Bitcoin Market Cap: $185 billion

BTC Dominance Index: 68.8%

*Data from CoinGecko

Key Levels to Watch

Support/Resistance: Following the recent price spike, Bitcoin is now facing resistance around the $10,300 area, along with the triangle’s descending trend line. Breaking above it would likely send Bitcoin to the next resistance around the aforementioned 50-day moving average line ($10,700-$10,800), before again reaching the seemingly unbreakable $11,000 region.

From below, Bitcoin is facing the good old $10,000 area (along with the MA-100) which has proved so far to be the Chinese Wall. Durable as it may be, a breakout is likely to produce a huge price move to the downside. Possible support levels could be $9,600 (weak), $9,400, and then the $9,000-$9,200 range. Further below are $8,800 and $8,500.

Daily chart’s RSI: This indicator communicates Bitcoin’s recent price action. The RSI is currently indecisive, hovering in a tight range. There have been no new lower lows, nor higher highs. It’s currently facing resistance at 47, before the significant 50 level.

Trading Volume: We mentioned in the previous price analysis that a vast price move was expected following four consecutive days of decreasing volume. It will be interesting to see what today’s volume candle looks like, as it will suggest whether the bulls are indeed back in the game.

BTC/USD Bitstamp 4-Hour Chart

BTC/USD Bitstamp 1-Day Chart

Source: cryptopotato.com

View original post