CV Market Watch™: Weekly Crypto Trading Overview (August 9-16, 2019)

(BTC) erased last week’s rally, breaking under the $11,000 and the $10,000 range within hours, in a mid-week sell-off. Altcoins continue to drift or further erase their positions, with short-term exceptions.

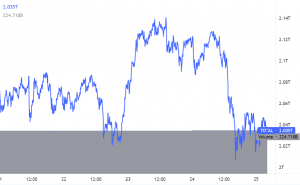

Bitcoin (BTC) recovered to $10,090.56, after dipping to the $9,500 range on Wednesday. The leading coin is down 14.45% since last Friday, as sentiment switched to “extreme fear”, a level comparable to the end of 2018 and the depth of the bear market.

The share of Tether (USDT) stabilized around 69%, as BTC volumes and transactions calmed down. BTC’s market dominance hovered above 68%, but so far fails to break above the 70% mark.

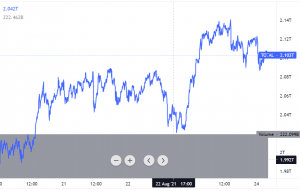

(ETH) is down to $184.68, leading the deeper correction of altcoins. ETH lost more than 13% since last week, despite still working as one of the most liquid altcoins.

XRP (XRP) fell through to $0.26, losing an…

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: investing.com

View original post