Bitcoin Holds Close to $12,000, Escaping Generalized Crypto Selloff

Investing.com – Although cryptocurrencies traded lower across the board on Friday, bitcoin bucked the general trend, moving close to the $12,000 handle.

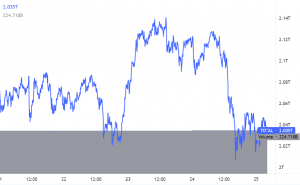

Total cryptocurrency market capitalization decreased to $308.93 billion by 11:43 AM ET (15:43 GMT), compared to $311.03 billion a day earlier.

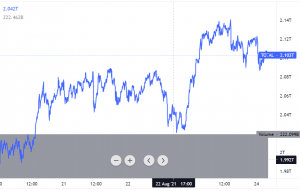

, the largest digital currency by market capitalization, gained 0.7% to $11,952.5 on the Investing.com Index.

Among its largest rivals, sank 5.0% to $210.38, lost 2.8% to $0.29799, slumped 5.7% to $311.1, while traded down 3.9% to $85.241.

While there were no clear drivers for the prices moves, Alexander Kuptsikevich, analyst at FXPro, said that bitcoin was , still “unable to develop its growth and pass June highs at $14,000”.

In crypto sector news, regulatory action appeared to be progressing, although remained far from implementation.

Fifteen nations are moving ahead with a system to monitor cryptocurrency transactions alongside the Financial Action Task Force (FATF), according to a report from the Asian Review.

The system would be aimed to stop the use of cryptocurrencies for illicit purposes such as money laundering or terrorist funding.

Blockchain analytics firm Elliptic had collaborated with researchers at the MIT-IBM Watson AI Lab in study presented this week that analyzed 203,769 bitcoin node transactions worth roughly $6 billion. The study found that only 2% of those transactions were deemed illicit.

Separately, Amir Zaidi, senior official responsible for oversight of bitcoin futures trading at the Commodity Futures Trading Commission, was reported by Bloomberg to be leaving his post. No reason for his departure was reported.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: investing.com

View original post