Bitcoin Swings Between Gains and Losses After Failing to Hold $12K

© Reuters.

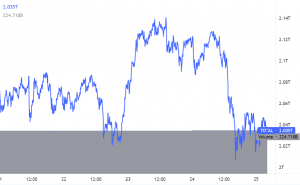

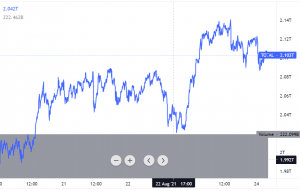

Investing.com — Bitcoin drifted between gains and losses Wednesday, as its rise above $12,000 was met with resistance.

rose 0.33% to $11,766, but remained below its session high of $12,153.

The directionless day for bitcoin comes as some continued to tout more gains ahead for the popular crypto on expectations that increased demand for safe havens may spark demand.

“Bitcoin is becoming a flight-to-safety asset during times of market uncertainty,” Nigel Green, chief executive of financial consultancy firm deVere Group, told The Independent.

” is currently realising its reputation as a form of digital gold. Up to now, gold has been known as the ultimate safe-haven asset, but bitcoin – which shares its key characteristics of being a store of value and scarcity – could potentially dethrone gold in the future as the world becomes increasingly digitized.”

But the day’s trading action suggests that it may be too early to characterize bitcoin as a safe-haven asset; gold, and other well know safe havens like the Japanese have rallied, while bitcoin remained flat.

Marcus Swanepoel, CEO of London-based cryptocurrency platform Luno agrees, insisting that demand for bitcoin during market turmoil is driven more by the potential for outsized gains than the popular crypto’s safe-haven characteristics.

“In times of market fluctuations, investors tend to move small proportions of their portfolios to bitcoin,” Luno agrees

Yet, bitcoin’s market cap, often used a gauge of demand, remained steady at about $208.9 billion, down from its peak of $218.7 billion a day earlier.

The subdued day of action in bitcoin was mirrored by other cryptos. fell 1.65% to $0.31018, lost 1.87% to $223.82 and was down 4.37% to $99.33.

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: investing.com

View original post