Lightning Network and Mass Adoption: What’s Missing?

Mass adoption is the mantra of every Bitcoin trader and the holy grail of most Bitcoin evangelists. And Lightning Network (LN) was one huge milestone on the roadmap of mass adoption.

But how exactly did it influence Bitcoin adoption and what are the next necessary steps?

Bitcoin Adoption With Numbers

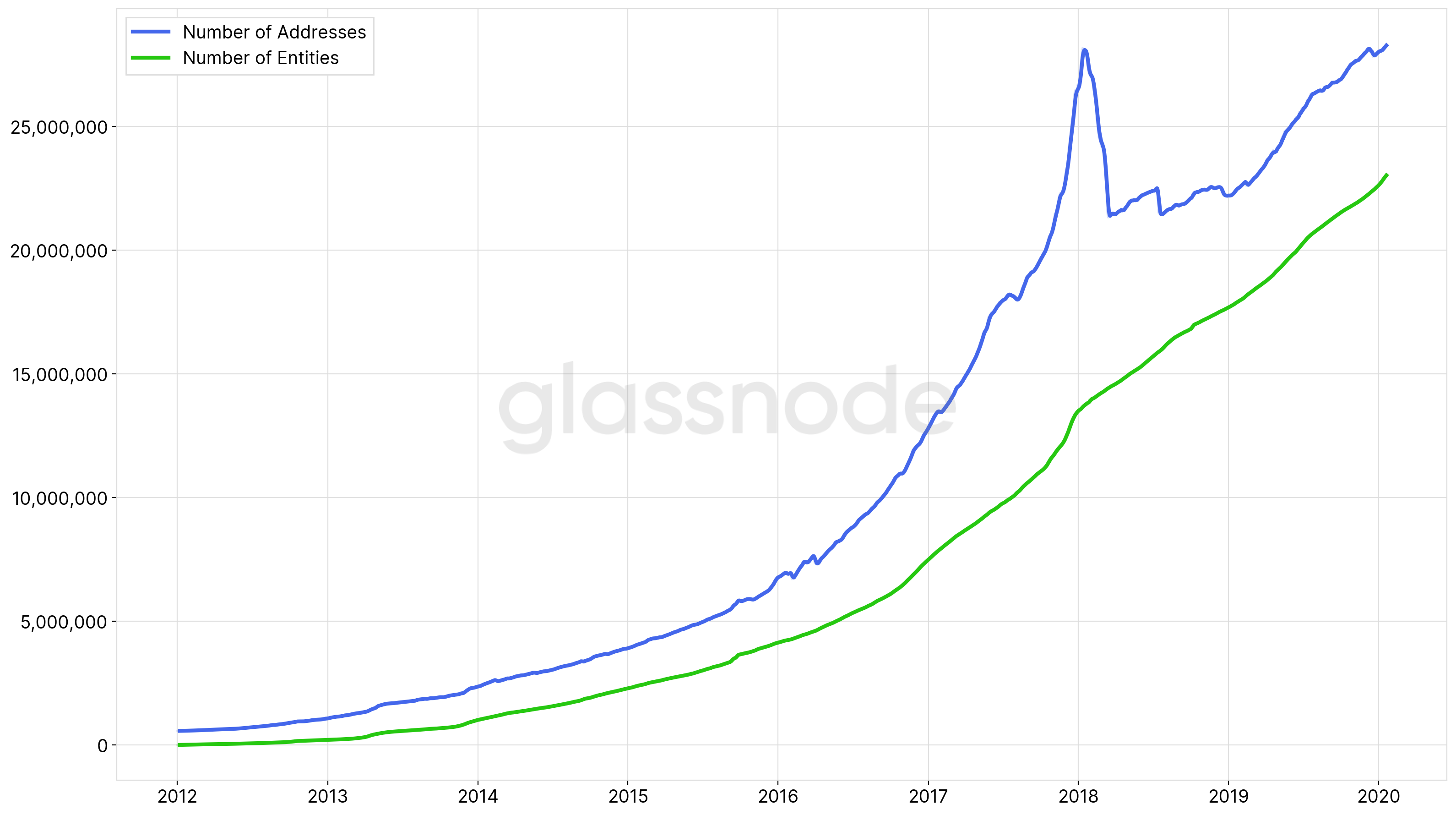

According to the recent Glassnode report, the number of entities holding Bitcoin has been continuously and steadily growing for a decade, and by January 2020 surpassed the 23 million mark.

Total number of addresses and entities with at least some funds. Source: Glassnode

The research also shows that while the number of BTC addresses increased unevenly, showing a sharp spike in the 2017–18 crypto winter zone, the number of entities increased in a more smooth line, much less beholden to the hype.

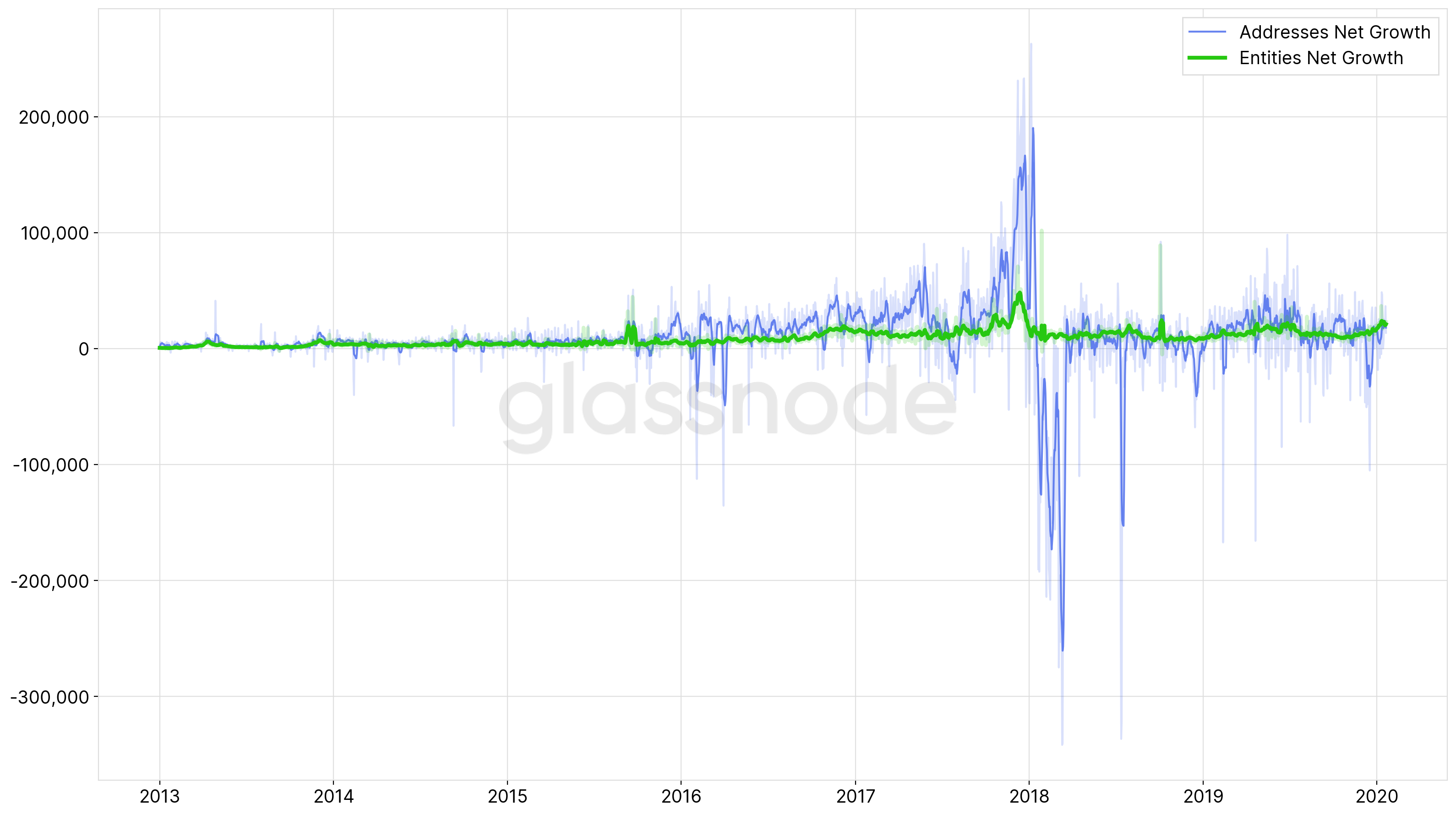

The chart comparing the daily net growth of addresses and entities within the network is even more indicative of the actual adoption dynamics.

Comparison of daily addresses and entities net growth. Source: Glassnode

While researchers note that daily net growth of entities is consistently positive, “in Bitcoin’s history there have been only 21 days so far in which the net entity growth was negative,” the growth itself is still pretty marginal, nothing to write home about.

Neither do we see any drastic changes which we can attribute to LN’s launch.

Wait, What is Lightning Network in First Place?

Lightning Network is a technical solution meant to solve Bitcoin’s inherent problems and to open the proverbial mass adoption floodgates. In technical terms, it is a second-layer protocol deployed on top of Bitcoin.

LN’s most important feature is off-chain payment channels which allow the network to achieve higher (and cheaper) transaction throughput while preserving the p2p nature of the Bitcoin protocol.

Breaking Down Why Lightning Network is Great for Mass Adoption

- LN transactions are instantaneous. Unlike Bitcoin transactions, which on average take 10 minutes. Sometimes, when the mempool is clogged, Bitcoin transactions can even take hours. This makes LN a huge boon for retail store owners who want to accept payments in Bitcoin.

- LN operates with considerably lower fees, thus finally making Bitcoin suitable for making micropayments, the lifeblood of modern online entertainment.

- LN transactions are not recorded on the Bitcoin’s blockchain, thus making them much more private. Perhaps not as important for mass adoption, but still a plus.

- Most importantly, the fact that LN employs off-chain transactions, does solve the most glaring problem of Bitcoin which lies in its atrocious scalability. LN, on the other hand, potentially allows for an almost unlimited number of simultaneous operations, which was perhaps the main technical issue preventing Bitcoin from potentially becoming a global currency.

Breaking Down Why Lightning Network is not so Great

A few months ago, a crypto-community member pretty much summed up the issues with LN in a single Twitter thread. Interestingly enough, the complaints mostly revolved around poor UX.

- Due to the p2p nature of the protocol, in order to process a transaction through a payment channel, both parties have to be online. Offline payments, i.e. simply sending a certain amount of coins to a known address regardless of whether its owner is online, in this case, are impossible.

- There is no clear picture regarding payment security. Everything happens off-chain and therefore LN can not fully benefit from the Bitcoin security model ensured by miners. It is also just easier to make a mistake and permanently lose money using LN.

- Concerns are also often voiced about the possible centralization of the network. For example, in mid-January 2019, more than 64% of the network capacity was controlled by a single entity.

What Can We Say About LN’s Adoption?

Lightning Network growth was initially very high during 2018 and early 2019, but it has significantly slowed down since. It became obvious that LN itself could not become a catalyst for Bitcoin’s mass adoption.

Something else needed to be done to improve UX and mitigate some other inherent Bitcoin’s issues like high volatility.

Integrating Crypto With Fiat

Whether we like it or not, the fledgling cryptocurrency market has always relied on fiat heavily. We have also seen a reciprocal process with central bank digital currencies (CBDCs) being widely discussed since last year and even more so after the Libra scare.

Coincidentally, Ethereum founder Vitalik Buterin has recently shown an acute interest in whether CBDCs and cryptocurrencies would be able to get along.

Important tech question about these CBDCs that are starting to pop up (CC @mg0314a): will transactions be cryptographically provable? That is, if I send you N coins, can I generate a cryptographic proof that this happened that can be verified on the ethereum chain? …

— vitalik.eth (@VitalikButerin) February 4, 2020

It becomes increasingly clear that as Bitcoin solves the issues of scalability and transaction costs, the next big step in the direction of mass adoption has to be a smooth fiat-to-crypto transition.

What’s Being Done?

Twitter and Square CEO Jack Dorsey has long been Bitcoin’s staunch supporter. In February 2019, he stated that he planned to add LN support to Square. At the same time, Square Crypto, a subdivision of Square taking over Bitcoin and cryptocurrency development at the company, was created.

A year later, Square announced that it was building a “Lightning Development Kit” for wallet and app developers, and also patented a new payment system allowing users to separately opt which (crypto or fiat) currency they wish to deal with in each specific transaction.

“The present technology permits the first party to pay in any currency while permitting the second party to be paid in any currency. In this way, the technology provides benefits that remove barriers to transactions that might inhibit international commerce, or commerce with certain types of currency,” the payment network’s description reads.

These developments are in line with Dorsey’s “non-commercial” initiative to support the Bitcoin community.

There’s a reason why many of the brightest minds from CS to economics and beyond have dedicated their careers to crypto. That said, mass adoption is almost impossible without great design. One of our goals is to accelerate the role of UX design in crypto. 🧠👁🌀

— Square Crypto @ Advancing Bitcoin (@sqcrypto) April 15, 2019

There are of course more crypto-to-fiat projects using LN popping up, the latest being Zap announcing a USD clearing system being added to their lightning wallet.

“Merchants can accept bitcoin and lightning payments with the same infrastructure, except they never touch the asset. Soon as we get the cryptographic proof that the lightning payment was made, we just credit their bank account immediately. They’re still dealing in dollars,” said Zap CEO, Jack Mallers.

According to Mallers “Zap’s wallet is positioned to bring “normies” into the crypto space for the first time, mainly because of this dollar-denominated front end.”

Conclusion

Why don’t people adopt Bitcoin more rapidly? The most common answers to that question are “it’s really complicated and I don’t want to mess up and lose my money” and “but I can’t pay at my local pub/grocery/etc. with Bitcoins.” Of course, there are also those guys who do not trust Bitcoin, period. There’s not much you can do about those ones.

This may sound a bit anecdotal, but the situation described above does mirror reality. Yes, Bitcoin has a huge UX problem and you still can’t reliably buy a beer with Bitcoins. Therein lies the vicious circle that stalls mass adoption.

Many of us were convinced that it would take Bitcoin to just become a better payment network to reach mass adoption. Admittedly, LN brought about many improvements in that direction. But we still can not pay for our beers.

To become a universally accepted method of payment in the retail and public sectors, Bitcoin will also need the versatility of instant crypto-to-fiat swaps. At least for a while, until mass adoption becomes a reality. Or, in layman’s terms, mass adoption will happen when you will be able to buy a beer with Bitcoins.

Follow us on Twitter and Facebook and join our Telegram channel to know what’s up with crypto and why it’s important.

Source: forklog.media

View original post