Bakkt Is Here: The Highly Anticipated Bitcoin Futures Platform Launches With Minimal Volume

The long-awaited launch of Bakkt, the Bitcoin futures trading platform of the Intercontinental Exchange (ICE), has finally happened. After more than a year of waiting, Bakkt opened for trading today, September 23. However, the trading volume as of yet is rather low, and the community is wondering whether it will pick up and if all the hype was justified.

Bakkt Launches Trading With Minimal Volume

BAKKT Markets, as it’s officially dubbed, is open for trading. According to the official website, the platform aims to bring federally regulated price discovery to the bitcoin market. It uses the same technology which powers the global markets of ICE, which is also the owner of the New York Stock Exchange (NYSE).

One of the key differences between Bakkt and existing Bitcoin futures trading platforms is that the former’s contracts are settled physically. This means that instead of receiving the cash equivalent upon contract expiration, traders receive actual bitcoins. This should, in theory, produce better price discovery and increased market liquidity.

Up to this moment, however, there have only been 27 contracts traded on the platform, which is rather low. Of course, the platform only launched a few hours ago.

Bakkt is seen as a gateway for institutional investors to enter the Bitcoin market mainly because of its regulated warehousing and supposed improved price discovery. The company reportedly received a license from the New York State Department of Financial Services (NYDFS) to hold the funds of its users.

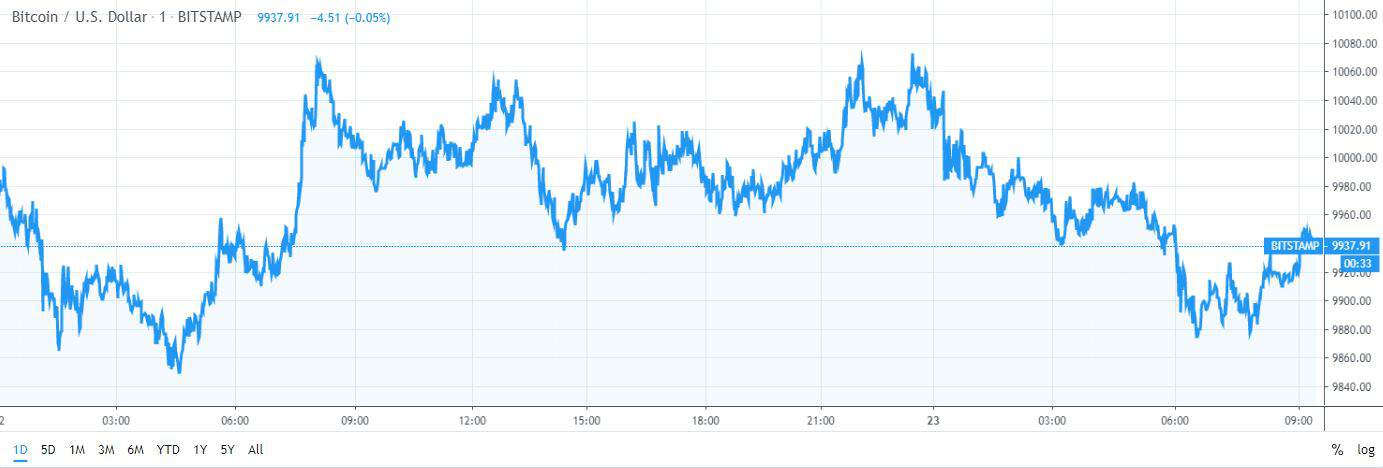

Bitcoin Market Remains Unfazed

Despite today being one of the most exciting days for the cryptocurrency community, Bitcoin’s markets have remained relatively unfazed. BTC is down 0.5% over the past 24 hours and is currently trading slightly below the psychological $10,000 level.

At the time of this writing, Bitcoin is trading at $9,988 and possesses a total market cap of around $179 billion. Bitcoin’s dominance rate stands at 68%, which is a decrease of around 1.5% over the past week. This means that altcoins are attempting to break out and regain some of their former strength. However, the altcoin markets are also bleeding today, as the majority of cryptocurrencies are trading in the red.

It will be very interesting to see how the entire situation develops and whether or not Bakkt will truly attract more institutional interest in the field, as that’s what the majority of observers seem to predict.

Source: cryptopotato.com

View original post