Bitcoin Flashback to Bearish 2018: Is BTC Forming Another Descending Triangle With a $6,100 Target?

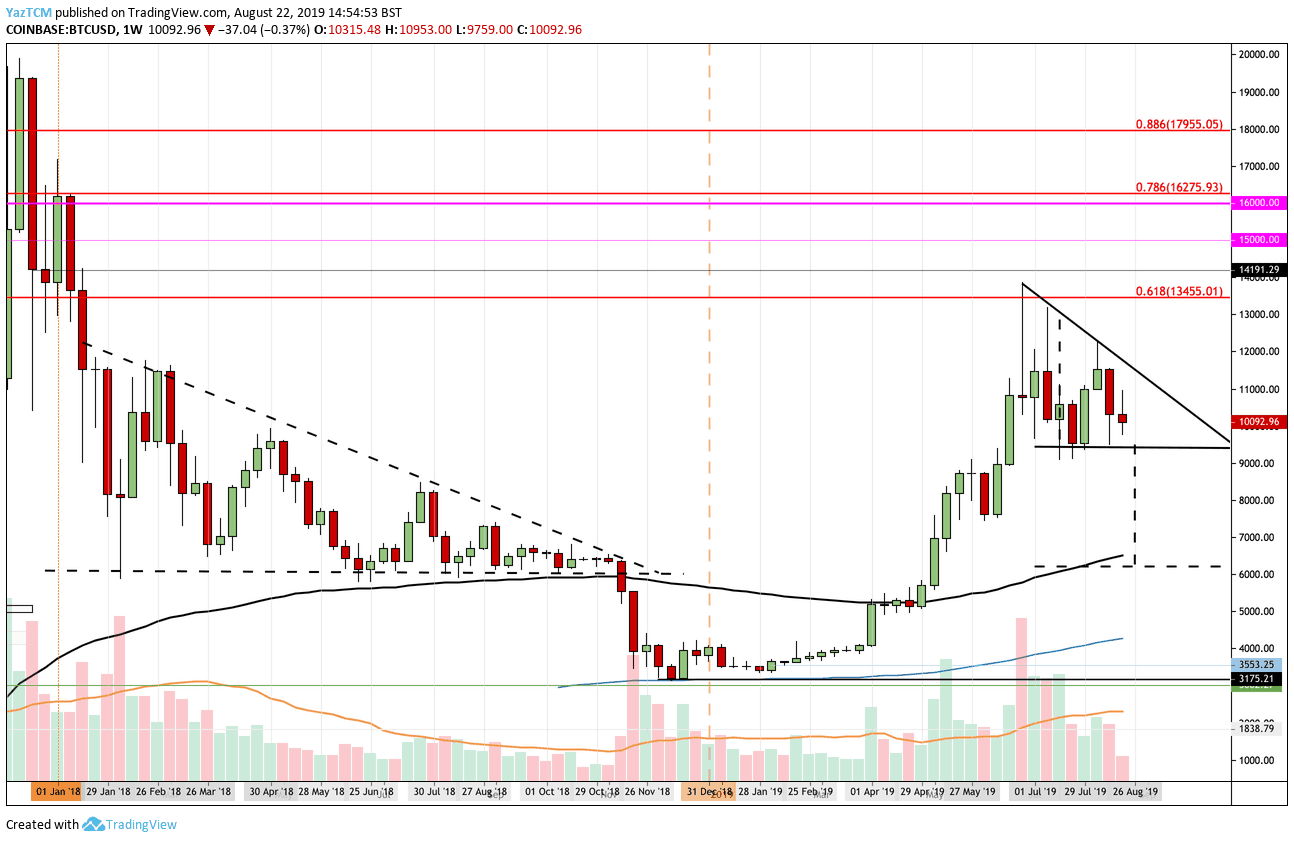

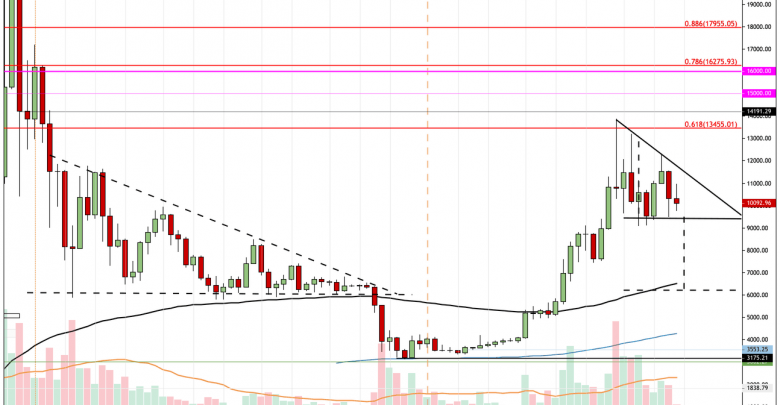

Similar Triangles, Different Sizes

The breakdown of the 2018 triangle resulted in Bitcoin’s price dropping by roughly 45%. Similarly, in the current descending triangle, a breakdown of the bottom of the triangle would technically predict a target of approximately $6,100, which is roughly a 36% price drop. On the other hand, if the bulls can defend the lower boundary of the triangle and push higher to break above its upper boundary, the pattern would be invalidated.

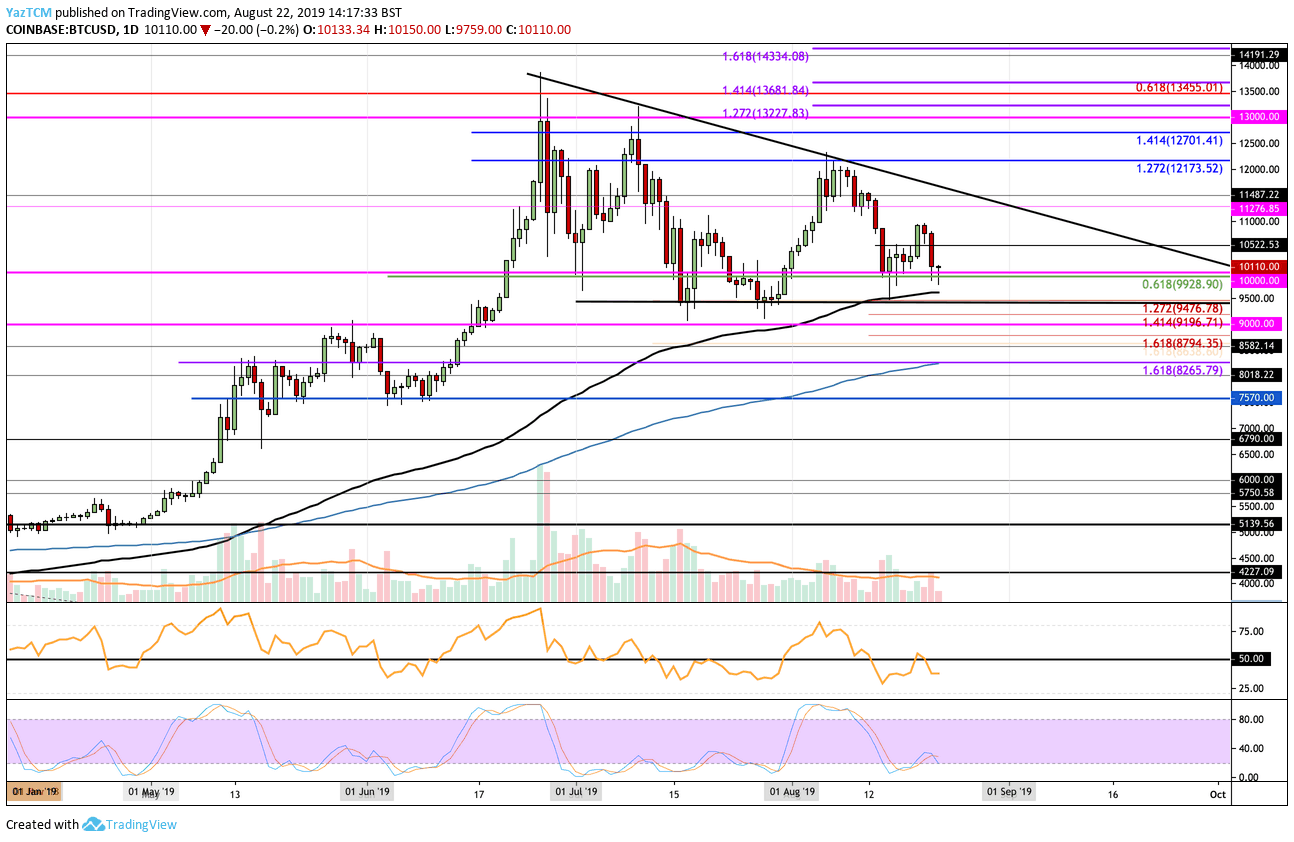

Short-Term Bearish, Long-Term Bullish

Analyzing the daily chart above, we can see that the base of the triangle is located in the $9,400 region. Bitcoin is currently trading at the $10,000 support level as the buyers battle to remain above it. However, it looks to me like the sellers will break beneath it to possibly test the lower boundary of the triangle. Before it can reach the lower boundary, the bears will need to break beneath the support at $9,928 which is the .618 Fibonacci retracement level.

If the sellers can break beneath this level, they will also have to contend with support at the 100-day EMA which is located just slightly below, at the $9,630 level.

The lower boundary is further bolstered by the short-term downside 1.272 Fibonacci extension level. If the sellers break beneath the support at the lower boundary, we can expect further support to be located at $9,196 (the downside 1.414 Fib extension), $9,000 and $8,794.

The technical indicators are all favoring the bearish case at this point in time. The RSI is beneath 50, which indicates that the sellers are in control. However, if the bulls can defend the lower boundary of the triangle, that may be enough to help bring the RSI back above 50.

Even if the price were to return to $6,100, Bitcoin would remain bullish in the longer-term analysis. As long as Bitcoin’s price stays above the $3,000-$4,000 area, the market is still in a long-term uptrend. Overall, Bitcoin has had a great run in 2019 after rising from beneath $4,000 to over $13,800.

Source: cryptopotato.com

View original post