As The Largest Crypto Exchange Goes Offline, Bitcoin And Altcoins Crash To New August Lows

As The Largest Crypto Exchange Goes Offline, Bitcoin And Altcoins Crash To New August Lows

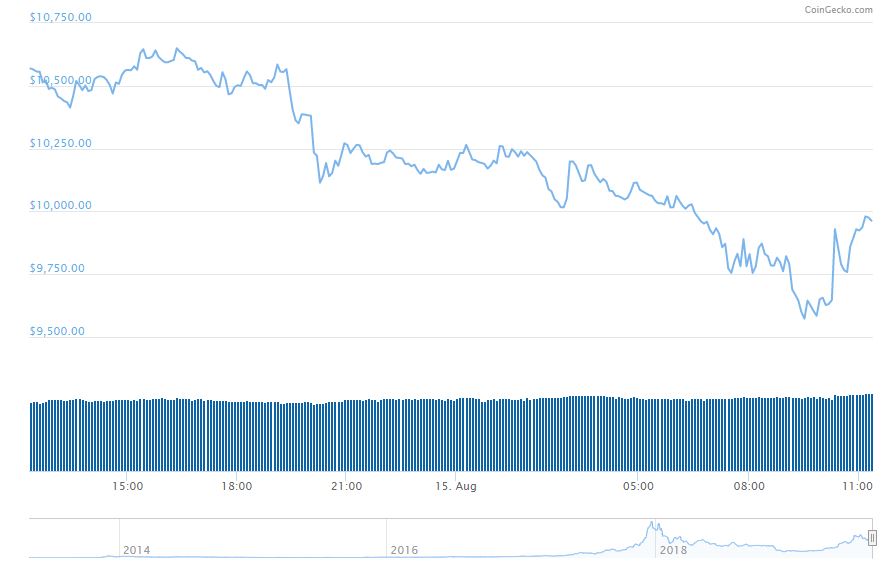

The cryptocurrency market lost around $25 billion today, as Bitcoin and all major large-cap altcoins plummeted heavily. This happened right after Binance, the world’s largest cryptocurrency exchange went down for scheduled maintenance.

Markets Plunge Heavily

The last 24 hours were particularly damaging for the cryptocurrency market as Bitcoin, as well as all major altcoins saw serious declines.

Bitcoin, for once, broke below the $10,000 level in a heavy plunge upwards of 7% at the time of this writing. The cryptocurrency is now trading at around $9,830.

All major altcoins are also bleeding heavily and most of them are seeing double-digit declines. The biggest loser from the top 10 is EOS which is down 13% at the time of writing this, followed by Bitcoin Cash and Ethereum, all of which lost upwards of 12%.

Against Bitcoin, the situation is a bit less alarming as the losses there are twice as little. More interestingly, Binance Coin (BNB) has managed to stay afloat and even marks slight increases of about 1.5% against BTC, despite being down 7% against the USD.

The entire market lost around $25 billion of its capitalization. However, we should also outline that Bitcoin’s dominance gained around 1%, once again reclaiming its predominant position.

Awkward Timing Once Again

All of this happened after Binance, the world’s largest cryptocurrency exchange, went off for a scheduled maintenance in order to perform a system update.

According to the announcement, some of the major updates which are to take place include optimizations of the matching engine, API, and WebSocket. More interestingly, Binance is set to introduce a new order type called OCO (One Cancels The Other).

In any case, the maintenance was intended to go for 6-8 hours, which is a considerable amount of time during which deposits, withdrawals, and trading is halted.

As Cryptopotato reported in the past, scheduled maintenances of the kind are an excellent opportunity for Bitcoin price manipulations by whales. Traders don’t want to stay out of control only to find their positions forced liquidation at the time the exchange goes back up.

Moreover, there is also a possibility for serious arbitrage trading because of the severe price difference before and after Binance went offline.

Source: cryptopotato.com

View original post