Don’t Blame Bitcoin Miners For Price Dips, Says Analyst

There’s little reason to believe that Bitcoin (BTC) miners are responsible for downturns in BTC’s price, according to crypto intelligence firm Coin Metrics.

Per Karim Helmy, Senior R&D Analyst ad the firm, this is due to the small scale of miner deposits in comparison to total exchange flows, and the lack of correlation between miner-exchange flows and price.

“At time of writing, miner deposits make up about 5.5% of exchange inflows. While most miner selling is done [over-the-counter (OTC)], this number is likely upward-biased … meaning the true on-exchange sell pressure provided by miners is probably even lower,” Helmy said in his recent research, stressing that the impact of Bitcoin miners on the broader market is still under-researched.

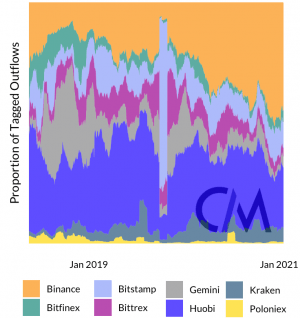

Also, the analyst found that Binance and Huobi are the two most popular crypto exchanges among miners.

Flows from Bitcoin miners into spot exchanges, 30-day moving average

“These results seem intuitive, since Huobi and Binance are the only two exchanges in the coverage universe that also operate mining pools. Both exchanges also have close relationships with miners, and have strong presences in Asia, where most miners are based,” Helmy said, adding that outflows from exchanges to miners are also dominated by Binance and Huobi.

He suggested that, in the future, miner-exchange flows could be used as a proxy for the geographic distribution of mining power.

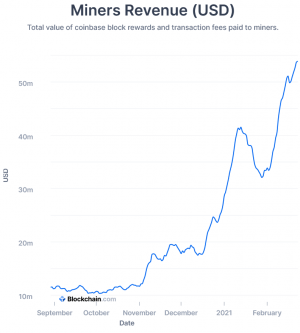

Meanwhile, in recent weeks, miners have been spending more newly generated BTC than they have been holding recently, according to ByteTree’s data.

BTC miners sell a part of their BTC to cover costs and stay profitable. Their revenue is earned from block rewards and transaction fees which are paid out in BTC.

At the time of writing (11:24 UTC), BTC trades at USD 50,529 and is up by 7% in a day and 2% in a week. It rallied by 56% in a month.

__

Learn more:

– Bitcoin Mining Becomes A Side Venture For Chinese Non-Crypto Firms

– Bitcoin Mining in 2021: Growth, Consolidation, Renewables, and Regulation

– Ethereum Miners Are Likely to Accept EIP-1559 Activation – Analysts

– Bitcoin Miners Buy Oversupplied Energy, Turn To Renewables – Nic Carter

Source: cryptonews.com

View original post