Did This USD 140B Manager Just Write a Guide For a Bitcoin Hodler?

Billionaire investor Howard Marks, co-founder of USD 139.6bn asset management firm Oaktree Capital Group, wrote an investor memo, shortly discussing bitcoin (BTC), but also delving into holding shares – providing points that could arguably be applied to hodling world’s number one crypto.

In his recent memo, Marks discussed conversations and conclusions made with his son Andrew, whom Marks describes as a successful “professional investor who focuses on making long-term investments in what the world calls “growth companies,” and especially technology companies.”

Finding that “value is where you find it,” Marks said that he wants to learn more about cryptocurrencies, as he’s not yet informed enough to form an opinion on them. He, however, added that Andrew, who is “quite positive on Bitcoin and several others […] thankfully owns a meaningful amount for our family.” Now, keeping this in mind, the section titled “Appendix: Dealing with Winners in Practice” becomes a particularly interesting read.

In it, Marks presents a version of a common, oft-had dialogue between his son and himself focused on investing, holding, and selling – and though this particular conversation is about shares, given Andrew’s appreciation for BTC, it’s interesting to observe how the word ‘shares’ could be easily changed for ‘bitcoin.’ Suddenly, we get arguments very reminiscent of those that one can hear from Bitcoin supporters.

Here are some points this ‘guide’ makes.

1. HODL!

Marks would ask his son if he’s tempted to make some profits when X is up Y% selling at a certain price-to-earnings (p/e) ratio. This would mean that Andrew is up by a specific amount; some of the gain should be put “in the books” to make sure not all is given back; valuation might be overvalued and precarious; and “no one ever went broke taking a profit.”

Andrew, however, would refuse to sell, stating he’s a long-term investor who thinks of his investment as being a part of a business and who can handle a short-term downward fluctuation. Furthermore, that specific company still has potential, he’d say, adding:

“Some years XYZ may do well, and some years it may do poorly (even perhaps very poorly). But if I’m right, I think it has a great long-term future ahead of it. The only way to be sure we participate in that future is to hold on throughout.”

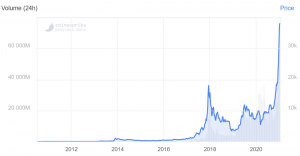

And now, it’s a good time to look at the BTC chart:

2. “Ultimately, it’s only the long term that matters.”

How about taking some profit if that company/project is overvalued in short term – you can then buy lower if it goes down, and there’d be less regret.

Andrew argues that selling a part of a something that has “enormous potential, strong momentum and great management” is not an option, as “great compounders are extremely hard to find,” while it’s much more straightforward to predict a long-term outcome than short-term price movement.

3. Metrics are useful, but not failsafe

Let’s take the mentioned p/e ratio as an example, what if it’s “awfully high,” Marks would ask his son. The latter would reply that this ratio “is just a very quick heuristic that doesn’t necessarily tell you much about the company”, it doesn’t necessarily mean something is overvalued, and it shouldn’t scare one off. “There are lots of things – about both the company’s present condition and its future potential – that don’t get picked up in a p/e ratio,” Andrew would say.

Therefore, “no single metric can hold the key to investment decisions, and the price of something should be weighed against its fundamental potential.”

4. Diversification is not always the best idea

Selling a piece of the company/project would mean going from what one knows well to what one knows less about. Per Marks’ son, it’s far better to own a small number of things about which a person feels strongly, adding:

“I’ll only have a few good insights over my lifetime, so I have to maximize the few I have.”

5. Price is not everything

This X we’ve been talking about “can’t be valued with a single number,” Andrew would say, and as it’s a young company, with the said large potential, which he expects will grow further, gaining more value, he’s not able to say where he’d start to sell. That point would depend on the performance of the fundamentals, and how this opportunity compares to the other available ones, while taking into account the amount of knowledge gained on the current opportunity. “Selling should be a function of watching how the future develops relative to your expectations and weighing the opportunity as it stands at any point in time against whatever else is out there, Andrew would say, with his father concluding that he’s “convinced,” adding:

“I hope you hold on!”

Or is it “hodl on“?

____

Learn more:

Most US Financial Advisors Want to up Crypto Holdings in 2021 – Survey

Ruffer Reveals Why They Poured GBP 550M in ‘Non-Sensical’ ‘Beast’ Bitcoin

Crypto in 2021: Bitcoin To Ride The Same Wave Of Macroeconomic Problems

Two Reasons Why Bitcoin Differs From Google, Amazon, & Facebook Networks

Bitcoin, Ethereum, XRP, Bitcoin Cash, Litecoin, Chainlink Price Predictions for 2021

VCs Learned Bitcoin & ICO Lesson The Hard Way – Marc van der Chijs

Source: cryptonews.com

View original post