‘Dirty Little Secret’, Bitcoin, Needs 4% In A Portfolio – CoinShares

Despite high volatility, traditional investors with a 60/40 stock and bond portfolio should allocate 4% of their portfolios to bitcoin (BTC), as the asset is “beginning to mature as a store of value,” according to an investment strategist at digital asset management firm CoinShares.

In a interview with Bloomberg Radio, James Butterfill said that an allocation of 4% is the optimal level because it represents a “sensible increase in risk that investors are willing to take,” with about a 1% increase in annual volatility.

The same message was also shared in a separate report from CoinShares released on Monday, where the firm shared more details on its proposed investment strategy.

In the interview, Butterfill added that “various strategies” can be used by traditional investors to mitigate some of the volatility that comes with holding BTC, including “quarterly rebalancing” as the digital asset either rises or falls in price:

“You would be selling off if you make a profit each quarter, and buying more if you lose some,” the strategist said, adding that “rebalancing each quarter helps mitigate that volatility problem.”

On the question of why the firm has chosen to focus on bitcoin rather than other cryptoassets or even companies that work with blockchain technology, Butterfill said that he sees bitcoin as “a bit like the US dollar, as the reserve currency of the crypto world,” while also revealing that most questions they get from clients are about bitcoin specifically.

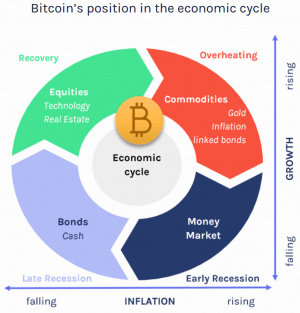

And when asked further about his personal outlook on the number one cryptocurrency, the investment strategist admitted that bitcoin, “like every other risk asset,” sold off in March when the COVID-19 crisis hit financial markets. “I think you have to understand where bitcoin is going in the coming years, and we believe it’s slowly changing into a store-of-value, a bit like gold,” he explained.

“Now, that means it will always polarize opinions. Some investors will always say it doesn’t have any particular use. You can argue the same for gold. But nonetheless, people see it as a store-of-value. And we think that’s what is slowly happening in the bitcoin space,” the CoinShares strategist added, admitting that owning bitcoin is seen as “a dirty little secret” among some institutional investors.

___

Learn more:

These Two Institutional Investors Allocated At Least 1% To Bitcoin

Bitcoin Just Got USD 250m Endorsement From Major US Company

Did Russian COVID-19 Vaccine News Crash Bitcoin and Gold Prices?

Bitcoin Demand Already Outpacing Supply – CoinShares’ Demirors

MyCrypto CEO Explains How to Survive (and Thrive) in a Crypto Bull Market

Source: cryptonews.com

View original post