Bitcoin Price Dropped Below $6,000 and Keeps Sinking

Today, on March 12, the price of Bitcoin dropped below $6,000, at some point reaching $5,900 on the Bitstamp exchange.

The chart below shows that the price drop was abrupt, amid an impressive surge in trading volumes:

Bitstamp BTC/USD chart. Source: TradingView

The top ten most capitalized assets right now look like this:

Top 10 cryptocurrencies by market cap. Source: Coinmarketcap

Most of the top cryptocurrencies dropped by almost 30%. The Tether stable coin repeatedly lost parity with the underlying dollar.

Binance CEO Changpeng Zhao reported some delays and malfunctions. According to him, the load on the system today was 5 times higher than previous peak values.

Bloodbath day.

🔶spot depth push experienced some delays, fixed

🔶futures UI 500 errors for a few minutes, fixed

🔶some futures ADL and margin calls, no cyclic crashes.Overall 5x system load than all previous peaks. Holding up so far, monitoring all systems.

— CZ Binance 🔶🔶🔶 (@cz_binance) March 12, 2020

According to trader Alex Krueger, the popular Chainlink token (LINK) at some point collapsed by 99.9%, to the level of $0.0001.

$LINK traded 0.0001, down 99.99%. pic.twitter.com/0etkoNxywk

— Alex Krüger (@krugermacro) March 12, 2020

The panic sale lowered the price of Bitcoin below $5,550 on the Binance futures platform.

Binance BTC price chart. Source: Binance

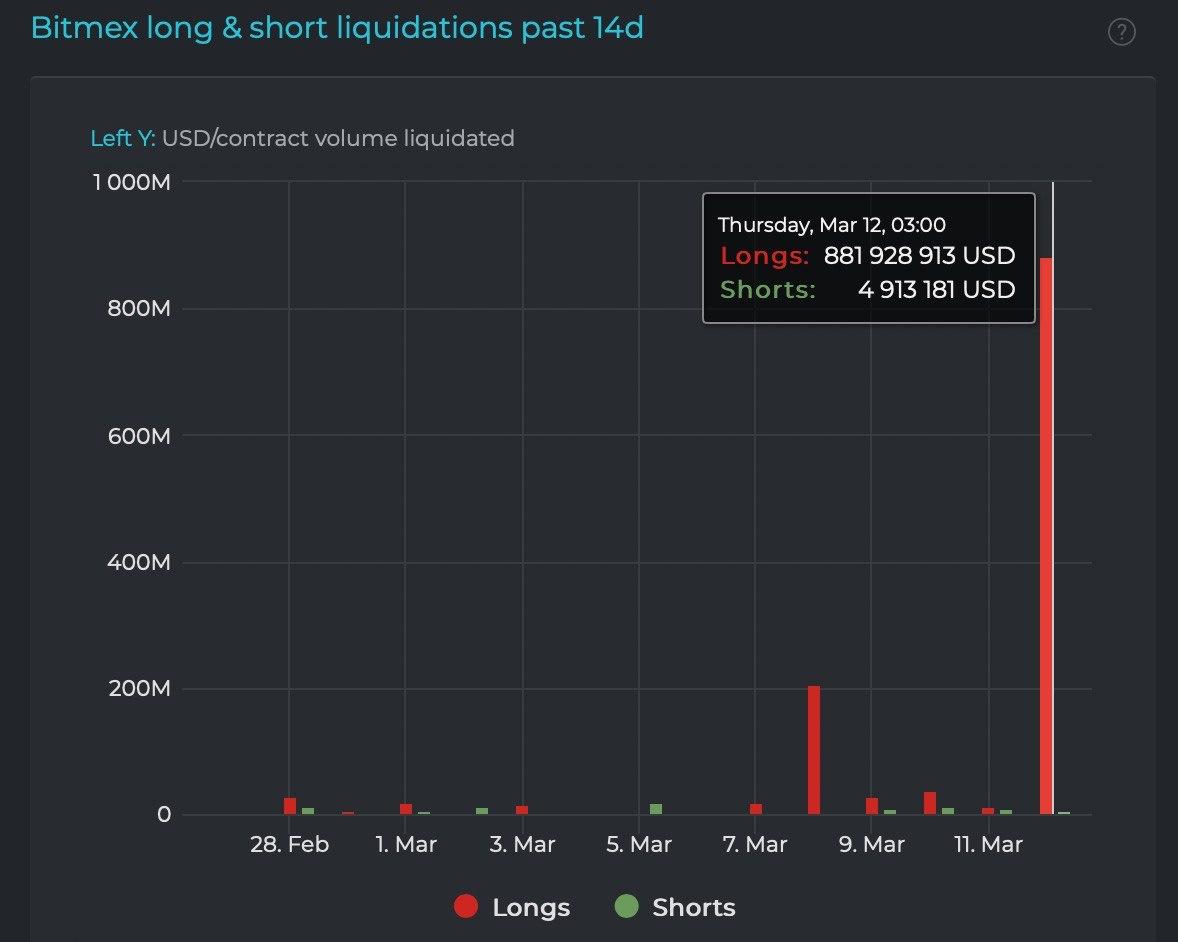

Bitcoin positions worth $900 million were liquidated on the BitMEX crypto-derivative exchange.

BitMEX long and short positions. Source: Datamish

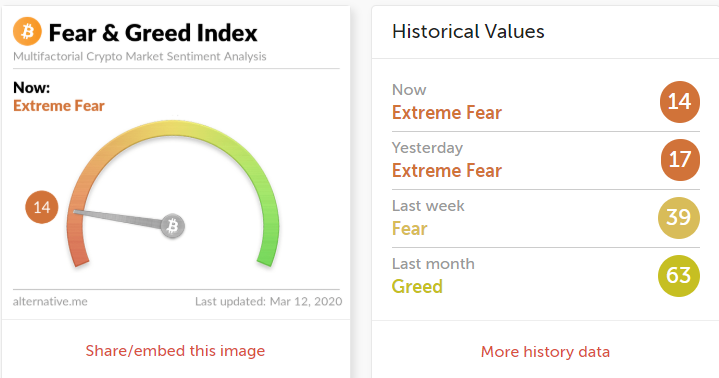

Following the unraveling panic, the cryptocurrency “fear and greed index” has reached a new low of 14 (“extreme fear”).

Crypto Fear & Greed index. Source: Alternative.me

The total capitalization of the cryptocurrency market decreased by about a quarter.

A sharp drop in the price of Bitcoin occurred against the backdrop of the continued collapse of traditional markets. The key European stock indices: German DAX, French CAC and British FTSE 100 have fallen by 6%. Futures on the S&P 500 signal the opening of the US stock market with at least a 4.5% fall. The value of traditional protective assets (gold, the Japanese Yen, and US treasury bonds) is slightly increasing.

The trigger for a new round of hectic sales in the stock market was the World Trade Organization’s recognition of the outbreak of the coronavirus as a global pandemic, as well as the introduction by the U.S. President Donald Trump of a ban on entering the United States from Europe.

Trump’s coronavirus travel ban announcement was made apparently without consultation with the travel industry or US allies and seems set to cause massive disruption | Analysis by @stcollinson https://t.co/h4YykHyaQL

— CNN (@CNN) March 12, 2020

Investors continue to raise interest rates on the approaching crisis in the global economy.

Stay tuned.

Follow us on Twitter and Facebook and join our Telegram channel to know what’s up with crypto and why it’s important.

Subscribe to our Newsletter

Source: forklog.media

View original post