CV Market Watch™: Weekly Crypto Trading Overview (September 6-13, 2019)

(BTC) kept up the pace this week, with volumes around $17 billion in 24 hours. Altcoins remain depressed, though giving off signals for a potential rally.

Bitcoin (BTC) traded at $10,326.40 ahead of the weekend, recovering from Thursday’s dip toward $10,000. Trading volumes thinned out toward the end of the week, sinking to $15 billion, lower than the usual on most days.

The share of Tether (USDT) sank toward 65%, as trading slowed down. BTC dominance shrank to 69.5% mid-week, then recovered to 70.4% on Friday, as altcoins still can’t manage to take off.

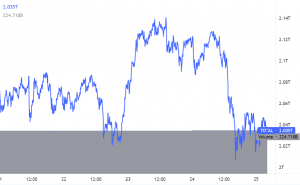

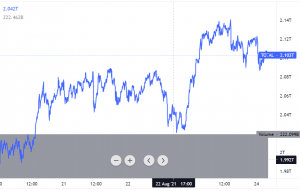

(ETH) hovers sideways, despite the rapid inflows of USDS on the Ethereum network. The ETH market price is at $179.63, briefly breaking above $180, with only a 2% net gain this past week.

XRP (XRP) remains at $0.25, despite the recent news of potential selling from and former partner Jed McCaleb. XRP also faces a new proje…

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

Source: investing.com

View original post