Bitcoin Struggles To Maintain $10,000: The Last Time Bitcoin Sees 5-digit Price In September 2019? BTC Price Analysis

As you probably know, technical analysis is not always right, but it’s correct most of the time. Three days ago while Bitcoin was trading around $10,600, our last analysis title suggested another re-test of the $10,000 level, when everyone was bullish, we saw this leg down coming-up.

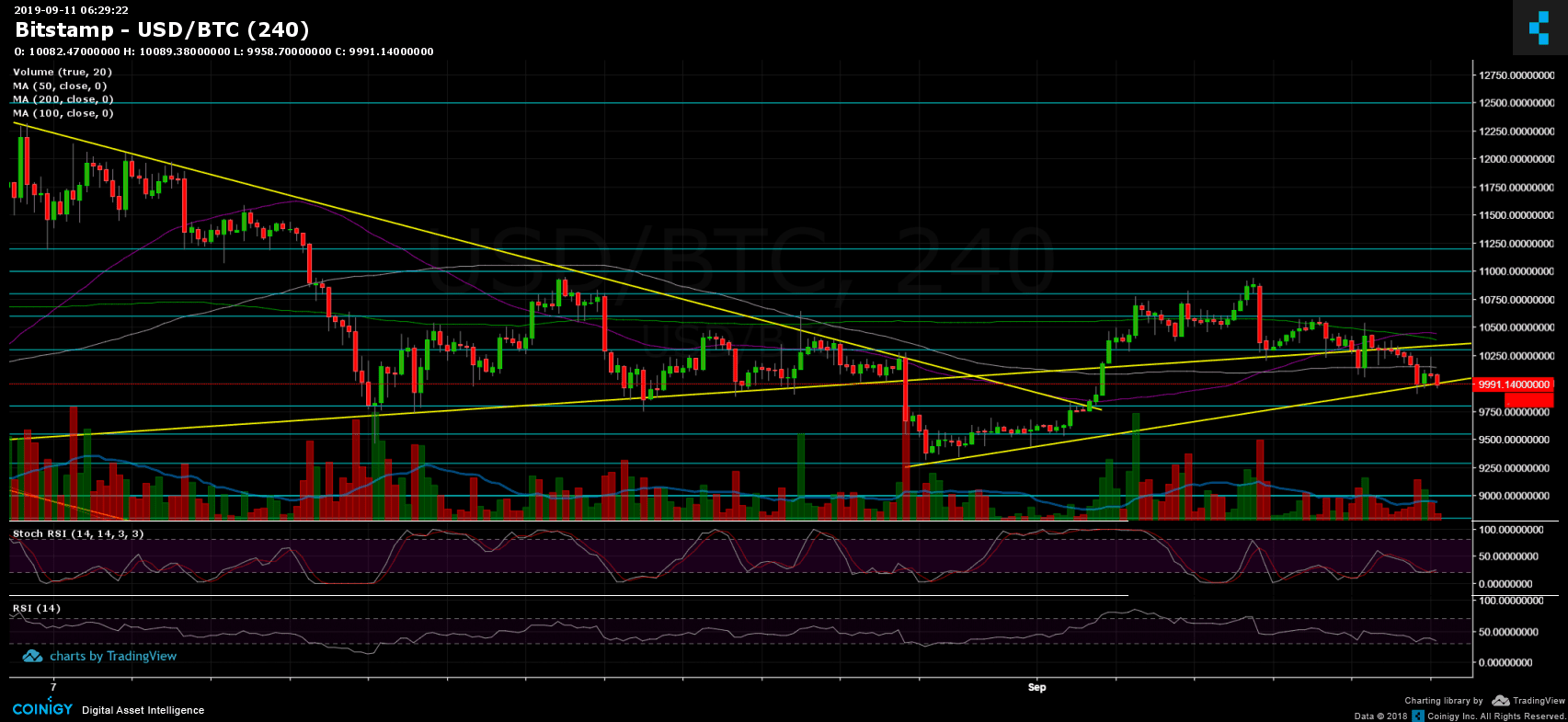

As you could notice, after getting rejected one more time by the crucial long-term descending yellow trend-line, started forming from the 2019 high at $13,880, Bitcoin plunged passed $10,000, marking the $9,880 support as its current daily low (as of writing this). This support is clearly seen on the following 4-hour ascending trend-line (marked yellow).

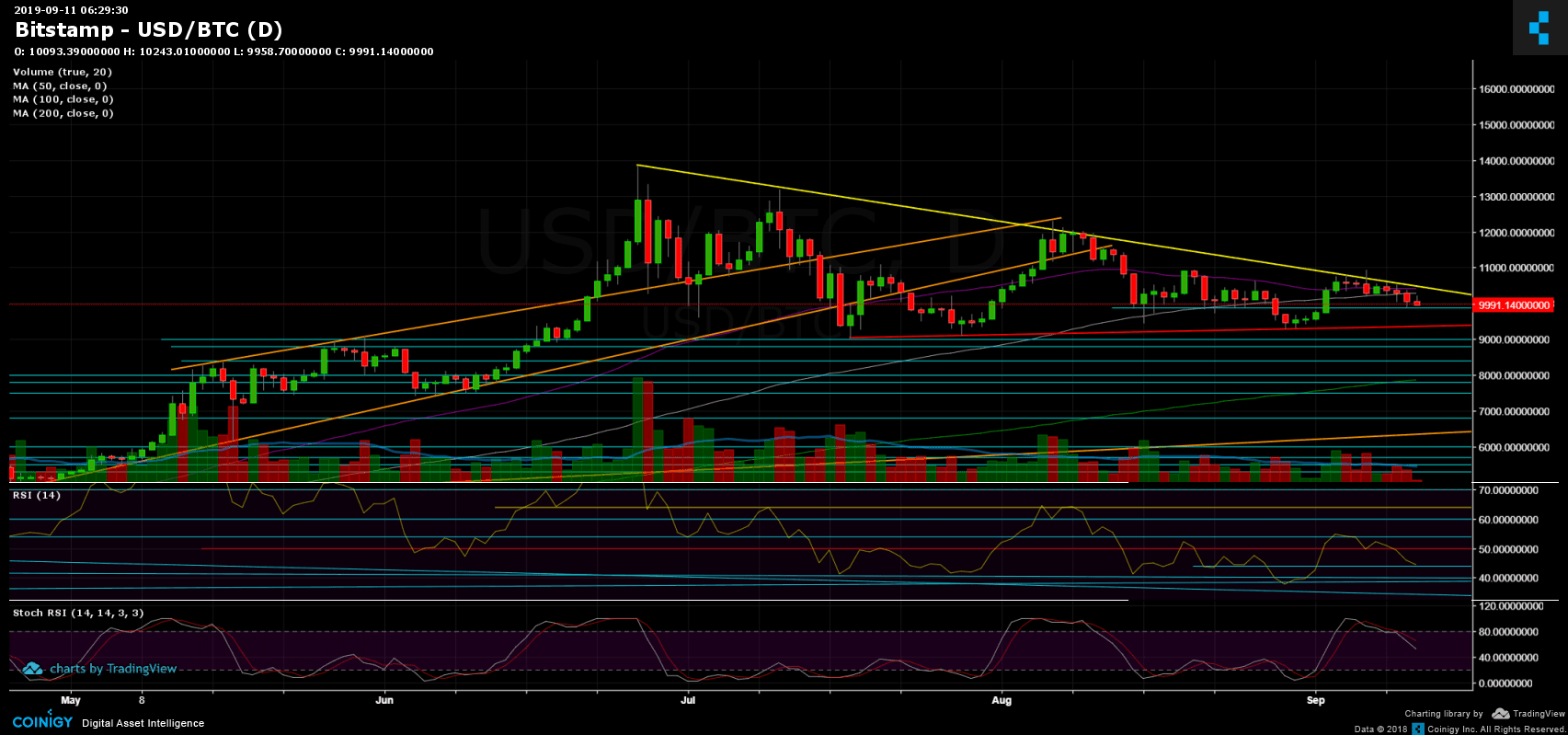

Looking at the bigger picture, the mentioned pattern of a substantial bearish triangle formation is still threatening the BTC chart. Of course, this can be invalidated at any moment; however, Bitcoin would need to break to the bullish side for it to take place and invalidate.

Simply put, the bigger picture from below is the crucial support line around $9,400, which is the last barrier before the triangle breaks to the downside. From the top, the triangles’ trend-line sits around the resistance level of $10,300 – $10,400. Hence, there is also a possibility of another leg up to the area mentioned above, before another final plunge.

Total Market Cap: $259 billion

Bitcoin Market Cap: $180 billion

BTC Dominance Index: 69.6%

*Data by CoinGecko

Key Levels to Watch

– Support/Resistance:

Bitcoin is now testing the critical $10,000 level as support. Nearby is the $9,880 support along with the 4-hour’s chart ascending trend-line. Further below lies $9600 (weak support level), before the crucial $9,400 level (the red ascending trend-line, the bottom line of the triangle). If broken down, Bitcoin is likely to produce a quick move down to $8,800 – $9,000 at first.

From the bullish side, the nearest level of resistance is the 100-days moving average line (marked white on the daily chart), around $10,250. Further above is the triangle’s descending line along with the 50-days moving average line (marked purple) at around $10,300 – $10,400. Above is the $10,500 – $10,600 zone.

– Daily chart’s RSI: After yesterday’s decline, the RSI is also standing on a decision point – the 44 levels. Overall, the RSI indicator tells the same bearish story of the Bitcoin’s price. Besides, since the stochastic RSI did make the mentioned cross-over at the overbought territory, Bitcoin lost almost $1,000 from its value.

– Trading Volume: Surprisingly, not a huge amount of volume followed the last move. Adding to the above, the daily volume is decreasing over time; this might tell on a coming-up huge price move.

BTC/USD BitStamp 4-Hour Chart

BTC/USD BitStamp 1-Day Chart

Source: cryptopotato.com

View original post