Bitcoin Surges $700 as Trump’s Latest China Slam Puts Global Stock Markets in the Red

US President Donald Trump has said that he will impose a 10 percent tariff on $300 billion worth of Chinese goods. Hence, the trade tensions between Washington and Beijing continue to build. This had an immediate effect on traditional markets, most of which tumbled in response, as investors are seemingly turning to Bitcoin and gold as hedges.

Trump Does it Again

In a series of tweets, the US President, Donald J. Trump, announced that he would place yet another 10% tariff on the remaining $300 billion worth of goods which China exports to the US.

He said that US representatives had just returned from China where they had “constructive talks” in regards to a future trade deal between the two largest economies in the world. However, according to Trump, China failed to live up to its earlier promises by not buying agricultural products from the US in sufficient quantities. Moreover, the country continues to sell fentanyl to the US, because of which “many Americans continue to die.”

…during the talks the U.S. will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country. This does not include the 250 Billion Dollars already Tariffed at 25%…

— Donald J. Trump (@realDonaldTrump) August 1, 2019

The US had previously hit another $250 billion worth of Chinese goods with a 25% tariff.

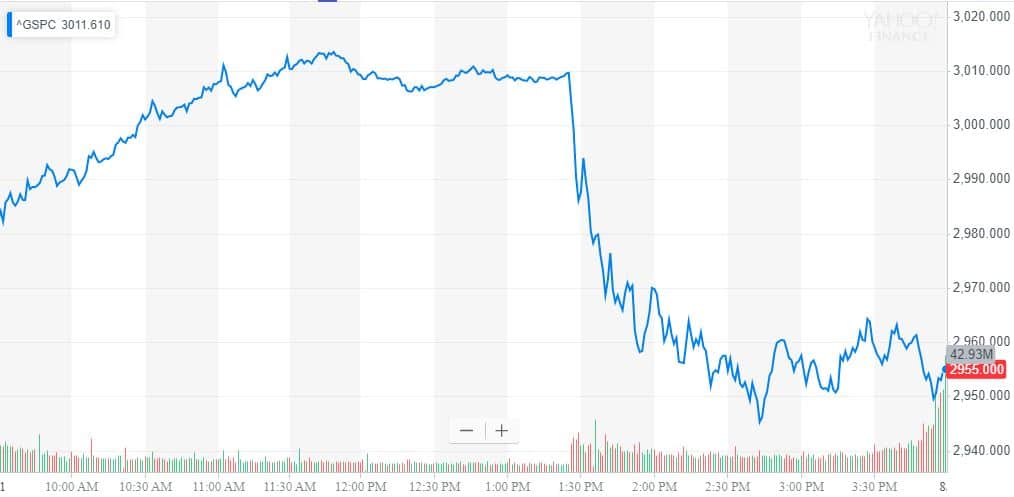

In response, traditional markets tumbled. The S&P 500 lost upwards of 60 points shortly after the news broke.

Additionally, the Dow Jones Industrial Average (DJIA) also tumbled, losing more than 540 points after the announcement.

As the Financial Times noted, it’s not just US markets which tumbled. European stocks also joined the selloff as Germany’s exporter-led Xetra Dax 30 fell upwards of 2 percent. London’s FTSE 100 is down 1.5 percent as well.

Bitcoin as a Safe Haven

It appears that investors might have turned to Bitcoin as a hedge against the tumbling traditional markets.

The world’s largest cryptocurrency by market value gained upwards of $700, representing a 6% increase, in the past 24 hours alone. Currently trading at above $10,500, Bitcoin possesses a market cap of almost $188 billion.

It’s not the first time this has happened, though. Back in May, when Trump announced that he intended to impose tariffs on Chinese goods, traditional markets reacted in pretty much the same way.

According to a popular Bitcoin analyst and blockchain investor, Oliver Isaacs, the trade tensions between the US and China could be one of the factors that propel Bitcoin further as investors see it as a hedge on their investments.

The net effect of the trade war between the US and China has led to the sudden interest in bitcoin as a hedge on investments.

On another note, gold is also up 1.10% today, as it’s increasingly considered one of the best safe haven investments in times of economic instability.

Source: cryptopotato.com

View original post